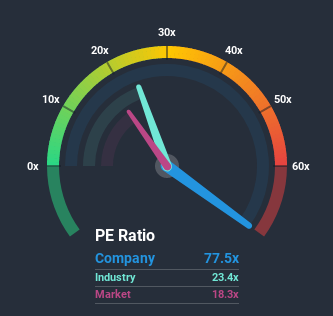

Yummy Town (Cayman) Holdings Corporation’s (GTSM:2726) price-to-earnings (or “P/E”) ratio of 77.5x might make it look like a strong sell right now compared to the market in Taiwan, where around half of the companies have P/E ratios below 18x and even P/E’s below 13x are quite common. Nonetheless, we’d need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

For example, consider that Yummy Town (Cayman) Holdings’ financial performance has been poor lately as it’s earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You’d really hope so, otherwise you’re paying a pretty hefty price for no particular reason.

See our latest analysis for Yummy Town (Cayman) Holdings

How Is Yummy Town (Cayman) Holdings’ Growth Trending?

There’s an inherent assumption that a company should far outperform the market for P/E ratios like Yummy Town (Cayman) Holdings’ to be considered reasonable.

Taking a look back first, the company’s earnings per share growth last year wasn’t something to get excited about as it posted a disappointing decline of 73%. As a result, earnings from three years ago have also fallen 81% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 13% growth in the next 12 months, the company’s downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that Yummy Town (Cayman) Holdings is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren’t willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Yummy Town (Cayman) Holdings revealed its shrinking earnings over the medium-term aren’t impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders’ investments at significant risk and potential investors in danger of paying an excessive premium.

You always need to take note of risks, for example – Yummy Town (Cayman) Holdings has 4 warning signs we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E’s below 20x.

Promoted

If you’re looking to trade Yummy Town (Cayman) Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

The easiest way to discover new investment ideas

Save hours of research when discovering your next investment with Simply Wall St. Looking for companies potentially undervalued based on their future cash flows? Or maybe you’re looking for sustainable dividend payers or high growth potential stocks. Customise your search to easily find new investment opportunities that match your investment goals. And the best thing about it? It’s FREE. Click here to learn more."Yummy" - Google News

July 27, 2020 at 10:53AM

https://ift.tt/32USezC

Yummy Town (Cayman) Holdings Corporation’s (GTSM:2726) Share Price Could Signal Some Risk - Simply Wall St

"Yummy" - Google News

https://ift.tt/3dchJOC

https://ift.tt/3c08sJp

Bagikan Berita Ini

0 Response to "Yummy Town (Cayman) Holdings Corporation’s (GTSM:2726) Share Price Could Signal Some Risk - Simply Wall St"

Post a Comment