On average, over time, stock markets tend to rise higher. This makes investing attractive. But not every stock you buy will perform as well as the overall market. Unfortunately for shareholders, while the Yummy Town (Cayman) Holdings Corporation (GTSM:2726) share price is up 45% in the last year, that falls short of the market return. However, the longer term returns haven't been so impressive, with the stock up just 0.9% in the last three years.

Check out our latest analysis for Yummy Town (Cayman) Holdings

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last twelve months, Yummy Town (Cayman) Holdings actually shrank its EPS by 70%.

So we don't think that investors are paying too much attention to EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

We doubt the modest 0.6% dividend yield is doing much to support the share price. Yummy Town (Cayman) Holdings' revenue actually dropped 29% over last year. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

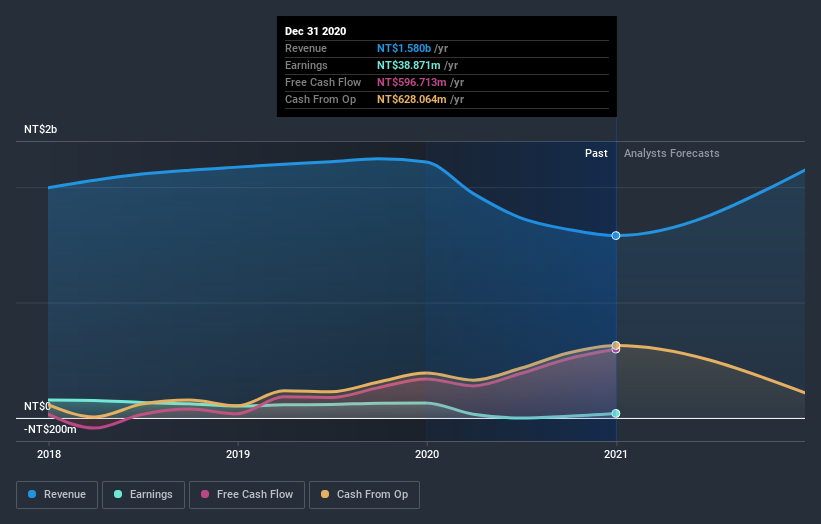

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Yummy Town (Cayman) Holdings' financial health with this free report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Yummy Town (Cayman) Holdings, it has a TSR of 53% for the last year. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Yummy Town (Cayman) Holdings provided a TSR of 53% over the last twelve months. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 10% over half a decade It is possible that returns will improve along with the business fundamentals. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 5 warning signs we've spotted with Yummy Town (Cayman) Holdings (including 2 which are a bit unpleasant) .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

Promoted

If you decide to trade Yummy Town (Cayman) Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

"Yummy" - Google News

April 16, 2021 at 01:37PM

https://ift.tt/3gg7A8G

Did Yummy Town (Cayman) Holdings' (GTSM:2726) Share Price Deserve to Gain 45%? - Simply Wall St

"Yummy" - Google News

https://ift.tt/3dchJOC

https://ift.tt/3c08sJp

Bagikan Berita Ini

0 Response to "Did Yummy Town (Cayman) Holdings' (GTSM:2726) Share Price Deserve to Gain 45%? - Simply Wall St"

Post a Comment