Tsuguliev/iStock via Getty Images

The MDLZ Investment Thesis Remains Tempting

We previously covered Hershey Company (NYSE:HSY) in an older article, covering the stock's excellent growth prospects, attributed to the aggressive M&A activities in order to diversify its confectionary offering with salty snacks.

For this particular article, we will be looking at Mondelez International (NASDAQ:NASDAQ:MDLZ) and sharing our findings about the stock, continuing the theme surrounding the confectionary market.

MDLZ is a stock that does not need any introductions, with its core offerings being a common staple in many household's pantry, namely Oreo and Philadelphia cream cheese. This is without forgetting the Daim Almond cake and Chocolate Crunch, which is one of our most purchased item from Ikea.

The robust branding power is also why the confectionary/ snack company has been able to report an exemplary FQ3'23 earnings call, with revenues of $9.02B (+6.1% QoQ/ +16.2% YoY) and adj EPS of $0.82 (+7.8% QoQ/ +10.8% YoY).

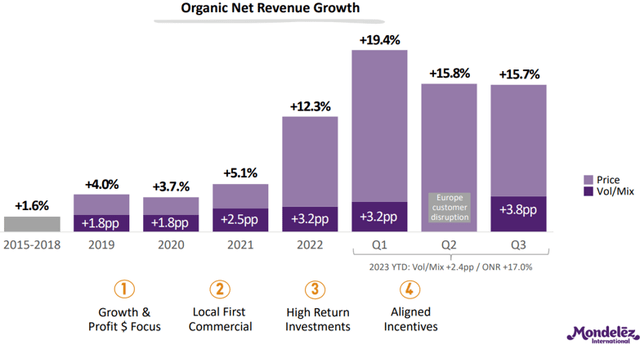

MDLZ's Net Revenue Growth

MDLZ

Most of MDLZ's tailwinds are attributed to the management's aggressive pricing actions at +11.9% and a smaller extent to the volume/ mix at +3.8% in the latest quarter, implying its sticky consumer base and excellent pricing power.

Investors may also want to note that its Organic Net Revenue Growth has been mostly attributed to its consistent price hikes since 2019, with a future reversal in prices unlikely.

This implies that the confectionary/ snack company's top and bottom line expansions will remain robust ahead, as highlighted by the management in the recent earnings call, with "pricing still expected to contribute more than an average year" in 2024.

The robust profitability has directly contributed to the notable improvements in MDLZ's balance sheet, with a moderating long-term debt of $16.41B (-9.5% QoQ/ -17.1% YoY) by the latest quarter.

This is on top of the sustained share repurchases over the past few years, with 88M shares retired since FY2019, or the equivalent of 6.4% of its float.

This optimistic development has also contributed to MDLZ's raised FY2023 guidance, with an approximate revenue of $36.05B (+14.5% YoY at the midpoint) and adj EPS of $3.422 (+16% YoY).

This is compared to the previous revenue guidance of +6% YoY and adj EPS growth in the "high single digits" offered in the FQ4'22 earnings call.

Rising Prices For Cocoa & Sugar

Trading Economics & Macro Trends

There are naturally still headwinds to MDLZ's near-to-intermediate term prospects, attributed to the rising cocoa prices over the past few years, with the commodity's future now priced at a record 45Y high of $4.23K per tonne (+7.6% MoM/ +69.2% YoY/ +81.5% from 2019 averages of $2.33K).

The same has been observed with sugar, as prices rose to a 10Y record high of $0.2688 per pound (inline MoM/ +34.4% YoY/ +124% from FY2019 averages of $0.12).

This is on top of the global supply chain issues, rising labor costs, volatile energy costs, and unfavorable FX headwinds, with MDLZ's gross margins naturally impacted to 37.9% over the last twelve months, compared to FY2019 levels of 40% (+0.1 points YoY)

However, with the PPI already cooling by November 2023, we may see the company's near-term headwinds moderate, allowing its gross profits to slowly return to its pre-pandemic levels, significantly aided by the "resilient consumer demand over private label alternatives."

The same has been highlighted in its growing sales in emerging markets by +19% YoY and North America/ Europe by +13% YoY in the latest quarter, despite the consistent price hikes thus far.

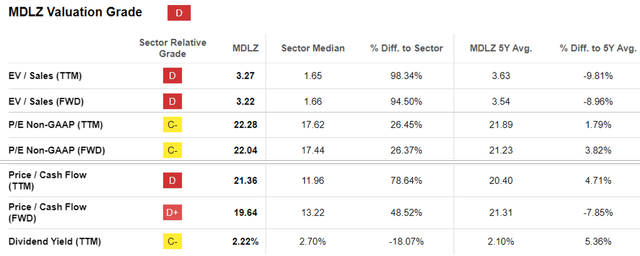

MDLZ Valuations

Seeking Alpha

For now, MDLZ's FWD P/E valuation of 22.04x does appear to be somewhat frothy compared to its 1Y mean of 21.58x, 5Y pre-pandemic mean of 20.56x, and the sector median of 17.44x.

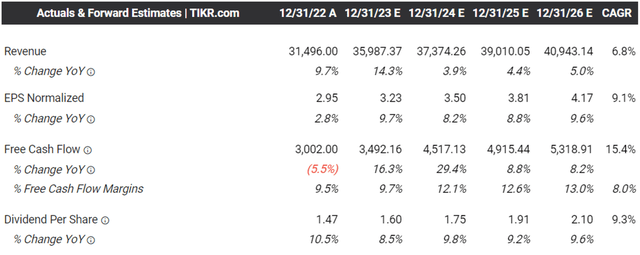

The Consensus Forward Estimates

Tikr Terminal

Then again, we believe that the slight premium is warranted, since the consensus estimates that MDLZ may generate an impressive top and bottom line expansion at a CAGR of +6.8% and +9.1% through FY2026.

This is compared to its historical CAGR of +3.3% and +7.2% between FY2016 and FY2022, respectively.

The MDLZ stock appears to be trading near its fair value of $70.35 as well, based on the management's raised FY2023 adj EPS guidance to $3.422 and its normalized P/E valuation of 20.56x.

In addition, there is still an excellent upside potential of +20.6% to our long-term price target of $85.73, based on the consensus FY2026 adj EPS estimates of $4.17.

MDLZ shareholders may also expect an excellent 4Y Dividend Per Share Growth at a CAGR of +9.3%, compared to its 5Y Growth Rate of +11.42% and the sector median of +5.06%. This is on top of the fairly decent forward dividend yield of 2.38%, compared to the sector median of 2.67%.

So, Is MDLZ Stock A Buy, Sell, or Hold?

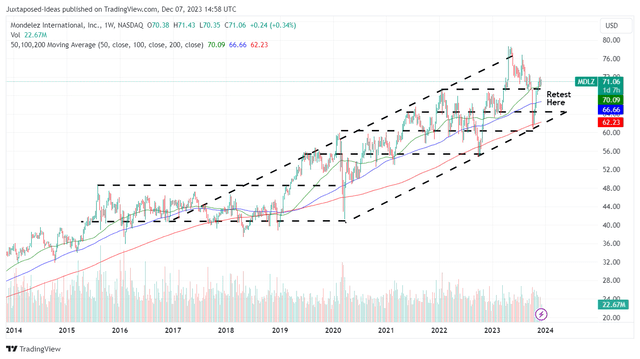

MDLZ 10Y Stock Price

Trading View

For now, MDLZ's 10Y stock returns have been impressive at +106%, otherwise at +151%, if we are to include dividends. These numbers well exceed HSY's returns of +97%/ +146% and not too far from the SPY's returns of +149%/ +197% over the same time, respectively.

MDLZ's dividend investment thesis remains more than safe as well, with a TTM Interest Coverage of 10.80x and a TTM Dividend Coverage Ratio of 2.03x, compared to the sector median of 7.50x/ 2.03x, respectively.

As a result of its well-balanced returns through capital appreciation and dividend income, we will be rating the MDLZ stock as a Buy.

This Buy rating does not come with a specific entry point, since it depends on individual investors' dollar cost averages and risk appetite, especially given the tremendous recovery by +13% from the recent October 2023 dip.

For now, based on its historical movement thus far, there is a chance that the MDLZ stock may retrace moderately to its previous support level of $64s before bouncing to chart a new top.

As a result of the potential -9% downside, bottom fishing investors may consider waiting for a little longer before adding at those levels for an improved upside potential.

"tasty" - Google News

December 10, 2023 at 02:00AM

https://ift.tt/Nopk6hB

Mondelez: Buy This Tasty Treat For Growth & Dividends Combined (NASDAQ:MDLZ) - Seeking Alpha

"tasty" - Google News

https://ift.tt/fDe5otm

https://ift.tt/Otazuek

Bagikan Berita Ini

0 Response to "Mondelez: Buy This Tasty Treat For Growth & Dividends Combined (NASDAQ:MDLZ) - Seeking Alpha"

Post a Comment