GMVozd/E+ via Getty Images

At first glance, the food distribution market may not seem to be particularly fertile ground for attractive returns in the investment space. After all, the overall growth of the industry should not be much greater than the population growth. On top of this, such a commoditized service should result in significant amounts of competition that eat away at profit margins. Even though this might seem the case, one company that has done incredibly well for itself is Performance Food Group Company (NYSE:PFGC). Although shares have underperformed the broader market over the past few months, the overall trajectory for the company has been positive. Sales, profits, and cash flows, all continue to rise nicely and, on an absolute basis, shares of the business look attractively priced. I definitely think that the easy money in this name has already been made. But given how the company continues to grow, and how shares are priced on both an absolute basis and relative to similar firms, I do believe that some additional upside still exists.

Mixed results are okay

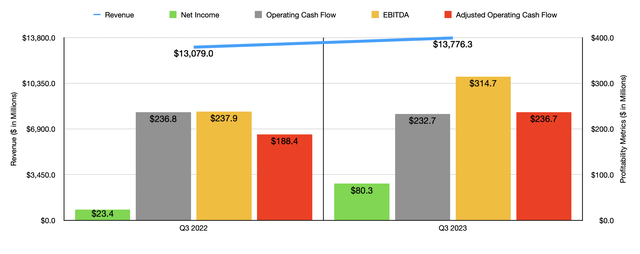

On May 10th of this year, the management team at Performance Food Group Company announced financial results covering the third quarter of the company's 2023 fiscal year. This is the only quarter for which new data is available that was not available the last time I wrote about the business in February of this year. In some respects, the data provided by management was quite positive. In other respects, the picture could have been better. Consider revenue. Sales for the quarter came in at $13.77 billion. That represents an increase of 5.3% over the $13.08 billion the company reported one year earlier. While this is a nice bit of upside, the sales reported by management actually missed analysts’ expectations by $161.2 million.

Author - SEC EDGAR Data

When you dig deeper into the sales composition of the company, you find areas of strength and areas of weakness. The most significant strength from a percentage perspective was the Vistar portion of the business. For those not very familiar with the company, Vistar is the portion of the enterprise that specializes in things like the distribution of candy, snacks, beverages, and other items, to vending machines, theaters, hospitality facilities, and more. It also provides office coffee service delivery. Revenue for that segment increased about 24.9% year over year, climbing to roughly $1.1 billion. This significant move higher was driven largely by an increase in selling price per case thanks to inflationary pressures that caused management to raise prices, as well as a change in product mix. Though not as significant, case volume growth also played a role.

Another portion of the company, the Foodservice business, reported a 5.2% sales increase, with revenue climbing because of higher selling prices per case and a favorable shift in product mix. Product cost inflation under this set of operations was about 3.5% year over year. New and expanded business with independent customers was rather impressive, with growth there coming in at 8.3% year over year. Meanwhile, the Convenience side of the company saw the slowest growth, with sales inching up 1.9%, with a roughly $0.2 billion decline in cigarette sales negatively affecting the company's top line.

On the bottom line, management generated some rather impressive results. Earnings per share came in at $0.51. That was more than triple the $0.15 per share the company reported one year earlier. It also translated to a beat over what analysts forecasted of $0.04 per share. On an adjusted basis, earnings came in even higher at $0.83 per share. That was $0.12 per share above what analysts thought it would be. The earnings per share that management reported translated to $80.3 million in net income. By comparison, that number one year earlier was $23.4 million. And this is not to say that every profitability metric proved to be positive. The weak point was operating cash flow. This actually declined from $236.8 million in the third quarter of 2022 to $232.7 million the same time this year. But if we adjust for changes in working capital, this number would have grown from $188.4 million to $236.7 million. Meanwhile, EBITDA for the company expanded from $237.9 million to $314.7 million.

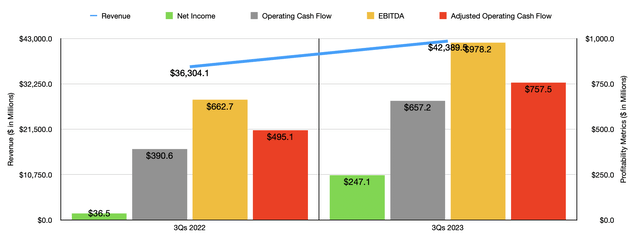

Author - SEC EDGAR Data

Just as was the case with third quarter results, guidance for the 2023 fiscal year as a whole was rather mixed. But before I get to that, I would like to point to the chart above, which shows financial results for the company for the first nine months of the 2023 fiscal year compared to the same time last year. This shows attractive year over year growth across the board, indicating that results in the third quarter alone were not a one-time thing. But I digress. For the year as a whole, management now expects sales of between $57 billion and $57.5 billion. This actually represents a significant downward revision compared to the $57 billion to $59 billion range that management previously forecasted. While this is negative, management did increase their guidance for EBITDA, calling for it to come in at between $1.34 billion and $1.36 billion this year. Prior guidance saw this coming in at between $1.27 billion and $1.35 billion. Despite these revisions, management is still forecasting revenue for 2025 of between $62 billion and $64 billion, with EBITDA still forecasted to come in at between $1.5 billion and $1.7 billion.

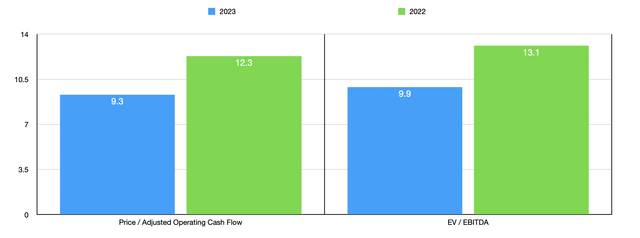

Author - SEC EDGAR Data

At the midpoint, current guidance for this year implies EBITDA of $1.35 billion. Management did not provide any guidance when it comes to other profitability metrics. But if we assume that adjusted operating cash flow will rise at the same rate that EBITDA is forecasted to, we would expect a reading for the year of $1.01 billion. Based on these results, the company is trading at a forward price to adjusted operating cash flow multiple of 9.3 and at a forward EV to EBITDA multiple of 9.9. This is a nice bit lower than the 12.3 and 13.1, respectively, that we would get using data from 2022. As part of my analysis, I did compare the company to five similar firms. On a price to operating cash flow basis and on an EV to EBITDA basis, three of the five companies were cheaper than Performance Food Group Company.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Performance Food Group Company | 9.3 | 9.9 |

| US Foods Holding Corp. (USFD) | 12.4 | 14.7 |

| United Natural Foods (UNFI) | 2.9 | 5.4 |

| The Chefs' Warehouse (CHEF) | 127.6 | 14.5 |

| The Andersons (ANDE) | 1.3 | 8.2 |

| SpartanNash Company (SPTN) | 7.7 | 7.9 |

Takeaway

Although investors might be disappointed with the relatively weak sales and the downward revision there, the most important thing is that profitability is coming in stronger than expected. Management remains optimistic that this trend will continue this year and that the company will ultimately go on to achieve its 2025 targets. On an absolute basis, shares are not exactly the cheapest. But they are cheap enough to warrant attention, while being more or less fairly valued compared to similar firms. Given all of these factors together, I've no problem rating the company a ‘buy’ like I did previously. For context, since I last wrote about the company in February of this year, the business has underperformed the market, with shares generating upside of 2.9% compared to the S&P 500's 3.8%. But when you look at when I first rated the company a ‘buy’ back in October of last year, shares have risen 33% compared to the 10.7% move higher seen by the broader market. I definitely think the easy money has been made by this point. But in all, I would argue that the company does deserve to move higher from here.

"tasty" - Google News

May 15, 2023 at 08:07AM

https://ift.tt/AjTSPNH

Performance Food Group Company Still Looks Tasty After Mixed ... - Seeking Alpha

"tasty" - Google News

https://ift.tt/R0fiKsp

https://ift.tt/WPOSUQJ

Bagikan Berita Ini

0 Response to "Performance Food Group Company Still Looks Tasty After Mixed ... - Seeking Alpha"

Post a Comment